Blockchain 2023: 6 whizzy tech trends plus use cases

What do blockchain have in common with soul or with solar power? Learn about intriguing blockchain technology trends.

Blockchain is much more than cryptocurrencies and has been for a long time. It is already well established in the business world, and ideas for its use are constantly on the rise. For this reason, it is worth keeping up to date and exploring the possibilities of blockchain technology, the potential of which is certainly still untapped.

In this article, you will read about 6 evolving blockchain-based technology trends, application scenarios and selected projects in which they are already employed.

1. Soulbound tokens: blockchain with soul

Why blockchain is the right technology for SBT

One of the key features of many blockchain platforms is that they provide some level of anonymity (or rather pseudonymity). Anyone can create an account on the blockchain and such an account is difficult to link to a user’s identity in the real world. While this is good for anonymity and privacy, it creates problems in use cases where it is the identity verification that would actually be useful.

Why is it called Soulbound

Unlike NFTs and cryptocurrencies, which can be traded on the open market and transferred from one wallet to another, Soulbound Tokens (SBT), are permanently tied to a wallet or account for its lifetime. Such wallets or accounts that hold Soulbound tokens are referred to as “Souls.” These tokens cannot be sold, and ownership is granted on a basis other than price, which in the case of NFTs is usually the main determinant of affiliation. The idea is that SBTs will only be able to be revoked by the issuer of the token in question.

Soulbound tokens and security

In order to protect Soulbound tokens from the possibility of theft, Vitalik Buterin (creator of Ethereum and one of the proponents of the concept) has proposed a community-wide adoption of a “social recovery model.” Through a “social recovery” mechanism, users can designate a group of individuals or institutions as “guardians” who have the ability to access and change the private keys to their soulbound token-assigned wallet if it is compromised.

You might have heard a lot about this concept before mid-2022, but a smooth implementation into practice remains to be seen. We will still have to wait for widespread application.

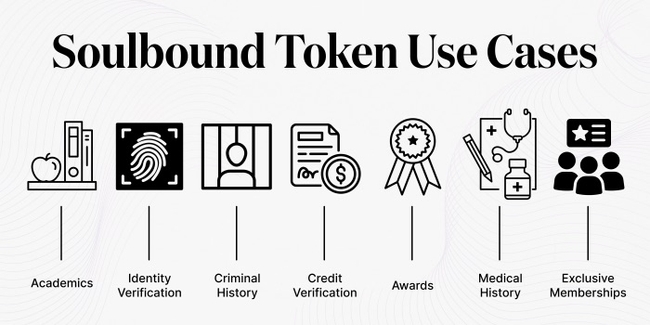

Examples of the use of soulbound tokens:

Safer lending

The ease of calculating public liabilities using SBT would enable open source lending markets. There would be new correlations between SBT and repayment risk, creating better lending algorithms that predict creditworthiness, thereby reducing the role of a centralized, opaque credit scoring infrastructure.

Stabilizing DAO

It will be possible to give ownership of governance tokens once and for good, preventing unequal distribution of power - the rich will not be able to buy voting rights from others, and thus will not be able to take full control of the DAO.

Assignment of medical records

SBT tokens would store all of our medical records, streamlining the processes needed for registration at medical institutions.

Assignment of identity documents

Attach identity documents to a given wallet, such as a birth certificate or ID card, making it easier to identify a person and ensure that we are dealing with a particular, real person.

Assigning access credentials

SBTs can replace passwords and similar user identity verification mechanisms, providing access to certain systems or resources.

Assigning scientific credentials

Soulbound tokens can encode certificates and academic credentials, such as diplomas, professional certificates or other similar documents. SBTs belonging to accrediting bodies (universities, training centers, etc.) can create a certificate that the owner of a particular Soul has obtained that certification.

Selected projects using Soulbound tokens:

poap.xyz

POAP, or Proof of Attendance Protocol, are digital badges in the form of NFTs, awarded to app users after attending an event that collaborates with the POAP platform, as a way to confirm their attendance at partner events. Organizers can create their own event on the POAP platform to customize the projects and products they will offer to attendees. POAP is a platform that still uses NFT tokens at this point, but has great potential to become a platform that issues SBT tokens.

proofofhumanity.id

Proof of Humanity (PoH) - is a social identity verification system built on Ethereum. PoH combines trust networks, reverse Turing tests and dispute resolution to create a list of people resistant to Sybil-type attacks (i.e., those in which an attacker creates multiple fake accounts to achieve some effect). Currently, we create a profile on the platform, connecting our digital wallet and performing a series of steps to confirm our identity (currently still without token credentials). The mere approval by the platform assures our identity. However, the portal has a predisposition to become an issuer of Soulbound identity tokens.

trinsic.id

Trinsic offers digital wallets where we can save our data in card forms, such as certificates, important documents, credentials, etc. A platform with the potential to issue SBT tokens.

everym.com

Evernym was founded in 2013 to solve the digital identity crisis. Evernym created Hyperledger Indy and Sovrin Network, and the company is also a co-founder of the cheqd network and a major contributor to Hyperledger Aries and Ursa. In addition, Everyn created Verity, the world’s leading verifiable credential platform, which has been tested for enterprise-class performance and already supports live deployments in finance, healthcare, travel, education and government.

2. Green cryptocurrencies

Why cryptocurrencies need to change

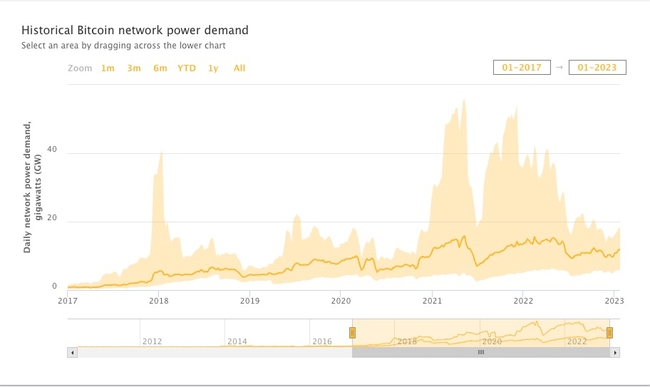

We will see attempts to replace fossil fuels as the primary form of energy, with a less damaging and renewable one - this is happening in other industries and will have to happen in this one too. Mining Bitcoin consumes huge amounts of power, which works against its reputation in the public eye. The growing awareness of cryptocurrencies’ energy consumption and repression in various countries, such as China, will likely force the crypto industry to adapt.

How to create more sustainable cryptocurrencies

The most obvious solution is simply to change the consensus algorithm from Proof of Work to one that is more favourable to the environment, such as Proof of Stake. This algorithm needs much less computing power to create the next block.

If the PoW mechanism is left in place, projects will be forced to change the primary form of energy supplied to one that is environmentally favorable - say, solar. The problem with the willingness to change is in the volatility of crypto prices – most projects may simply not be able to change their infrastructure if mining a given token yields little profit.

However, changing laws (going more and more green) will be directed toward making amendments ordering mines to obtain environmentally friendly energy, so we’ll see a lot of changes in the coming months and years in terms of greater environmental friendliness.

Bitcon network power demand. Source: Cambridge Bitcoin Electricity Consumption Index

A selection of projects that are committed to green cryptocurrencies:

Lancium: Responsive Technology. Reliable Grid. More Renewables Growth.

Houston-based technology company Lancium has announced plans to spend $150 million on renewable crypto mining companies in 2022.

Crypto Climate Accord

The Crypto Climate Accord organization aims to have all blockchains powered by renewable energy by 2025.

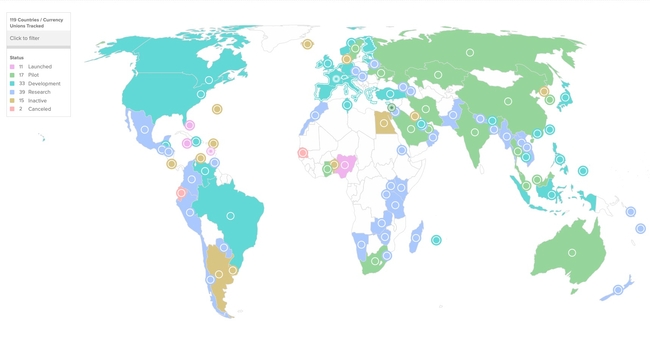

3. Regulated digital currencies: CBDC

What is CBDC

CBDCs are digital currencies of central banks. In the coming months/years, official cryptocurrencies, backed by fiat money, will be the norm for each country. CBDCs are issued and regulated by national monetary authorities or the central bank. Central bank digital currencies are centralized coins and transactions using them cannot be anonymous.

You can hear about central bank currencies in an episode of our podcast, in which we explain in simple terms some complex issues from the world of technology and Web 3: Jak w Blockchain: Episode about CBDC (in Polish)

CBDC related projects:

Multiple CBDC Bridge - mCBDC

The Bank for International Settlements (BIS), together with Thailand, Hong Kong, China and the UAE, published in 2021 a report on the second phase of the mBridge project, which aims to create multiple CBDC agreements for a faster, cheaper, better and more efficient mechanism for foreign exchange transfers and operations.

Project Dunbar

The central banks of Australia, Singapore, Malaysia and South Africa, in cooperation with the BIS, have begun testing an international clearing platform as part of Project Dunbar. As of March 2022, the project has successfully built two prototypes to enable international clearing across multiple CBDCs.

Project Helvetica

Project Helvetia was a collaboration between the Swiss National Bank, BIS and commercial infrastructure operator SIX. In 2020. Project Helvetia explored the possibility of issuing wholesale CBDCs on SIX’s distributed digital asset platform. In January 2022, it was announced that Project Helvetia was successful in integrating wholesale CBDC into the country’s core banking infrastructure.

Project Jasper

In 2017, the Bank of Canada launched Project Jasper, which ended after 4 phases and included cross-border tests with the Bank of England and the Monetary Authority of Singapore.

Project Aber

The UAE and Saudi Arabia launched a bilateral CBDC pilot project called Project Aber in 2019 and concluded that decentralized ledger technology can successfully facilitate cross-border transactions.

Project Jura

The Innovation Center of the Bank for International Settlements (BIS), the Bank of France and the Swiss National Bank have launched Project Jura, which, together with a private sector consortium led by Accenture, will experiment with the use of wholesale CBDC (wCBDC) for cross-border settlement on a distributed ledger technology (DLT) platform.

Onyx multiple wCBDC

In July 2021. Banque de France announced the successful completion of a cross-border payment experiment with the Monetary Authority of Singapore that used JP Morgan’s Onyx unit.

Updated map of CBDC development worldwide. Source: Atlantic Council - Shaping the global future together.

4. Find2Earn: games utilizing blockchain and NFT tokens

What Find2Earn means in practice

This is an opportunity to transform the NFT acquisition process into a game suspended in augmented reality. Developers will be able to put their NFTs across the map, using AR technology and geolocation. This means that users will, for example, physically move around in the real world, locating and tracking the NFTs they want to receive.

The form of the game depends only on the creators’ creativity and technological capabilities. So we can imagine racing someone around the city with an AR lens (or just a phone in hand) to get a selected NFT that is hidden somewhere on the edge of the map.

Selected projects with Find2Earn model:

Rebase Portal

reBASE is a blockchain-based platform (formerly known as DROPP) that uses geolocation technology to connect the real world with virtual and augmented reality technologies using the blockchain. ReBASE is in the process of developing the Find2Earn model and has not yet announced specific dates for enabling this form of minting.

Potential Find2Earn view. Source: Rebase Portal

5. Prepaid cards in crypto currencies

How do the crypto cards work

It is a service, allowing the transfer of a given amount of cryptocurrencies to an intermediary and receiving in return a prepaid card with a value equivalent to the deposited funds in the chosen fiat money. A solution conducive to crypto adoption, being easy to use even by newcomers.

Perspectives for prepaid cards in crypto

The adoption of cryptocurrency payments varies from country to country and takes time. On top of that, constantly changing regulations deter manufacturers. Prepaid cards do not require changes to the payment system by the vendor, allowing the consumer to shop at any store that offers prepaid cards.

Selected projects using crypto prepaid cards:

payb.io

A site that allows customers to purchase most products with cryptocurrencies, including prepaid cards - buy anything, pay crypto.

Beegoz.com

Marketplace with selected prepaid cards in Poland.

6. Multi chains bridges: communication between various blockchain networks

Multichain – what is it

Simply said it is just communication between networks. These solutions allow different blockchains to communicate with each other without the help of intermediaries, mimicking the way the Internet works today.

Multichain can render many platforms and projects obsolete. Particularly at risk are interfaces that allow tokens to be transferred from just one chain to another. Compared to those that will operate on multiple chains, the functionality of the single ones will be seriously limited.

Examples of multichain use:

Cross-chain yield farming

Zoptymalizowane zyski poprzez farming i agregację w wielu sieciach blockchain, które zapewniają najwyższy zwrot z aktywów.

Cross-chain secured lending

Collateral can be deposited in a smart contract on the “native” blockchain, while allowing users to borrow token on a different, higher-bandwidth chain.

New types of DeFi applications

Cross-chain services open up a new category of DeFi applications that can be developed for the multi-chain ecosystem.

Low-cost transaction calculation

Transaction data can be processed on a high-bandwidth chain, and the subsequent calculation results can be sent to a more expensive but more trusted network for transaction settlement.

Fungible multi-chain tokens

The ability to create tokens on different networks in a single project so that they interoperate with each other.

Multi-chain NFT’s

Creating and developing NFT projects on multiple networks, ability to flip a series of NFTs from one network to another.

Selected projects using multi chain bridges:

ChainLink

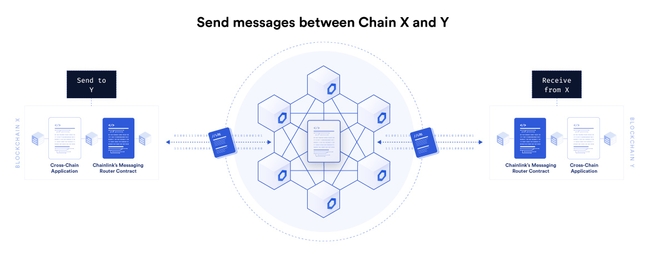

ChainLink initially functioned as a middleware between the smart contract and the external data sources necessary for its operation. However, an offshoot of the project has emerged, providing multi-bridging in various aspects. The Cross-Chain Interoperability Protocol (CCIP) provides developers with an universal, open standard for creating secure services and applications that can send messages, transfer tokens and initiate actions across multiple networks. With an universal messaging interface, smart contracts can communicate across multiple blockchain networks, eliminating the need for developers to write custom code to build blockchain-specific integrations. CCIP opens up a new category of DeFi applications that can be developed by developers for the multi-chain ecosystem.

Multichain - Cross Chain Router Protocol (CRP)

Multichain (a project born from Anyswap) is a multichain platform for cryptocurrencies and NFT’s. The solutions developed by Multichain allow almost all blockchains to interoperate. For coins that have native tokens on multiple chains, Multichain will exchange cryptocurrencies between chains using liquidity pools. If there is no such native coin, Multichain locks the token in a smart contract and mints the pegged token on the target chain.

LayerZero

LayerZero is an interoperability protocol designed to transport messages between blockchains. Simply put, LayerZero is a layer that allows message transport for smart contracts to communicate between chains. It works as a collection of smart contracts on any supported blockchain. It is worth mentioning that the developers of LayerZero have created the Stargate project - a liquidity transport protocol using LayerZero.

THORChain.org

THORChain is a decentralized liquidity protocol that enables exchanges between 7 chains, including Bitcoin, Ethereum, Binance Chain, Dogecoin, Litecoin and Bitcoin Cash. THORChain is backed by its native RUNE token, which deterministically accrues value as more and more assets are deposited on the network. THORChain does not wrap assets before swapping; instead, it uses native assets in THORChain. In 2021, THORChain suffered an attack that resulted in a loss of $4.9 million. The network, faced with the theft, decided to stop operations (it has the ability to do so if 1/3 of the nodes give the command) and implement security patches.

Omnite - Home of Upgradable Assets

Omnite is a Layer 1, smart-contract-based protocol that allows NFT tokens to be transferred between blockchain networks in a decentralized manner without the need for a centralized intermediary. The platform works on all leading EVM networks such as Ethereum, Polygon, Avax, Fantom and BSC. When changing networks, token addresses on different networks remain the same.

Rango Exchange

Rango exchange is a Dex that supports multiple networks. Rango is an aggregator that can perform complex and multi-stage exchanges, combining all DEXs, bridges and DEX aggregators across the DeFi world, including:

- DEX: Uniswap, Sushiswap, Bancor itp.

- DEX Aggregators: 1inch, Matcha etc.

- Cross-Chain DEXes, such as: Thorchain.

- Centralized/decentralized bridges: Binance Bridge, Terra Bridge, etc.

The Cross-Chain Interoperability Protocol. Source: Chainlink

What’s in store for blockchain

This list, while extensive, does not exhaust the potential that blockchain technology has to offer. Blockchain has gained immense recognition in the last decade, thanks to Bitcoin. However, its capabilities go much further, and use cases are multiplying right before our eyes.

We can observe how blockchain is changing or downright revolutionizing the functioning of many industries. Blockchain technology has proven to be a turning point for many areas of the economy, including healthcare, real estate, cyber security, education, supply chain and logistics, or IoT.

The features of blockchain technology, such as transparency, security and resistance to counterfeiting, contribute to its growing appreciation and position it as one of the most revolutionary technological tools of our century.